The Developer Chronicles: Master-planned Projects

In this series, I describe master-planned projects. The discussion focuses on the difference between a one-off project and a multi-stage, multi-year planned development. I explore the factors that great development teams grapple with every day. I hope you find it of value.

AND you can also contribute to this opensource education by commenting with your own experiences, strategies, tactics and ideas here on LinkedIn. That’s where we can really embrace group network effects for continuous improvement in development management.

The DC: Master-planned Projects #8 Selling the Dream Location

There is only one word that a master-planned developer likes better than “Sold”. And that’s the three letters that one day eventuates after it:”Out”. Selling Out, with a sizable profit* of course, is the ultimate goal for any development. In a master-planned project that can be a long long time away. And there are many other differences between selling a master-planned and a one-off development.

[ *Yes you can measure your profit in social good if you are in the not-for-profit or government housing sector.]

A Different Kind of Selling

In this book I describe four levels of real estate development branding: company branding, master project/estate branding, project building/use branding and location branding. For a one-off project, with a single-use (like office premises) you may not even need to mention your company, pay lip service to the location and focus solely on the product in question. But in a master-planned project, you are likely going to have to grasp different ways of selling at all four levels.

This edition will focus on location branding.

When beginning to sell a master-planned development you might not have a lot of material to start with. Selling a location that no one can yet see takes a vision. A vision to implant your dream, of the desirability of the development you are creating, into the minds of potential buyers. The further your project lies from existing infrastructure – that is the schools, shops, parks, places of work and play, motorway exits, ferry ports, train station and everything else that makes up a neighborhood – the more expansive the vision you must present to potential buyers. If you intend to develop all that as part of your project (aka your master-planned project is essentially a new suburb) then at least you have control of delivering this vision. But if your master-planned project is merely within a new or growing suburb then the vision you present has to line up with the reality of the social and physical infrastructure that may be created under the control of others.

Regardless, more than any one-off project which can count on the infrastructure and community that already exists, you must sell the location first and foremost.*

[Yes, yes, yes, of course, there are exceptions: Pioneering product – like apartments where only townhouses have previously existed – also requires you to ‘sell the location’, for that type of product. New developments in an area experiencing (or about to) gentrification will also require you to help people understand why they should buy or lease in this downtrodden location.]

Branding the Location

Before anyone even considers the product you intend to deliver, let alone the credibility of the developer and builders behind delivery, they have to be interested in your location.

A master-planned project (consistent with the definition as I have used throughout the master-planned project series) IS a new location. And if it’s a new estate in the middle of the property desert – greenfield development, surrounded by actual greenfields – then no one knows this location even exists. Buyers won’t be searching in your location so they may never get to see the property you intend to sell. The solution is simple, you need to bring this new location to people’s attention. Sell them the dream location!

That is going to take a bit of effort and expense. Unless demand for your property product is on the parabolic upswing, where desperate buyers will sniff it out from cities away, expect to undertake a location branding and promotion exercise.

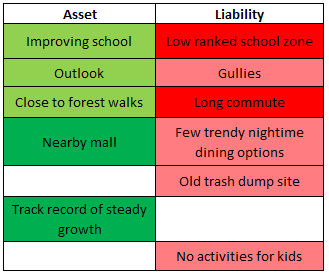

The first step of that location branding is to figure out what assets you have to promote. Borrowing from the accounting profession, the 4 line formula goes like this:

- Take all your current location assets

- And your current location liabilities

- Calculate your location brand equity

- Then, increase the location brand balance sheet by adding amenity profit

Location Assets. Why is your location the bee’s knees for your development? Is it a growth area where buyers can get in early and watch the infrastructure, as well as their real estate values, rise over time? Or are you so far away from the smog and chaos of the city? Closer than others to the ocean/river/lake/forest/mountains? Do you have views? More comfortable micro-climate? More transport options to get to the city, shopping, and employment? Or are you in the zone for a great school (that’s always a BIG asset ?

Yes, it’s not just physical assets. Include social and economic assets and contemplate with a wide brush. Perhaps the area is in part of a winning sports franchise, has lower property taxes or favorable development incentive tax policies.

Get the team to think hard enough and you will end up with a list of dozens.

Write down everything that is great about each asset. Take some pictures, video, drone captures, produce a one-page case study, hold interviews to discuss the ‘asset’ with local celebrities and business people – whatever you can think of to build up the collateral of location assets. This will be well worth the effort and is important for your marketing promotion later on. Needless to say, make sure you take your target market (the buyer’s and end-users) point of view. As a developer, you may have fallen in love with the knowledge that you have purchased a derelict timber factory and removed an eyesore from the community by flattening it to build a suburban office park. But will the tenants care?

Then prioritize the assets. That might be according to value, target market importance, wow factor, or whatever adds most benefit to your vision. The top three become instant forerunner topics for your key brand messaging when you come to promotion time.

Location Liabilities. It’s quite probable your location has some negatives. Just being in a place that’s new (or at least new for the product you want to deliver) for some will be negative. Less than desirable school zone? Surrounded by a lower socio-economic demographic than your target market? Lots of hills, and gullies, without views? Miles away from anything to do, like shopping and sports? Longest commute home into the setting sun on a one-lane crowded highway? High property taxes? Prone to flood/fire/slips? Site of a famous murder?

And again think broadly, liabilities such as restrictive laws on alcohol sales and restrictions on pets to protect native species might exist. Don’t let your buyers be the ones that alert you to their existence, without a strategy to curtail their importance.

Document the issues that these liabilities create. Being well informed and aware of the bias against your master-planned project’s location – before you go to market – gives you an opportunity to strategize how to deal with it.

Now prioritize the liability list in terms of their dream shattering potential. The top liabilities will be those most obvious and emotional. And they will be the target buyer’s key objections to your development’s location.

Calculate Location Brand Equity.

Now join the lists together. Log them in a spreadsheet, create a matrix, rank by colour – whatever works for you best to present and analyze the information. Here is a basic example.

Want to take it further? Then assign a score or a weighting to each item, even a percentage of the target market that you think will find this a deal-breaking or deal-making issue. Then calculate the total score. You might even create your own elaborate Urban Development Rating Tool. Regardless of your approach, the process in itself will help you identify where there are gaps that need to be plugged. Sometimes the asset will easily offset the liability, and other times that might be a stretch too far. For example, being close to forest walks probably will only marginally offset a long commute. But a brand new regional sized shopping mall down the road could easily trump a lack of trendy late night dining options in the area.

The combination of the assets and the liabilities is your net location brand equity. If we take my simple example above, the more dark green and the less dark red, the stronger your location brand balance sheet is.

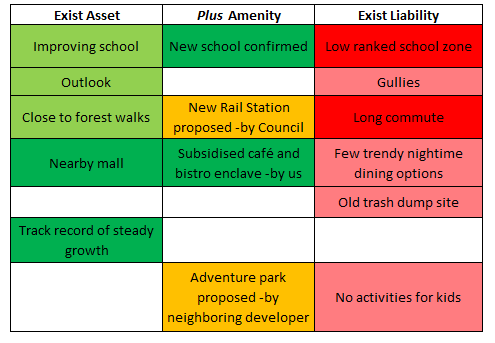

Add Amenity Profit to the Brand Balance Sheet

Amenity is what you use to plug the gaps. Amenity is all the social, economic and physical infrastructure that adds value to your location. Adding amenity adds location brand equity.

Unless you are producing a fully gated community I am talking about public amenity. Amenity that creates the fabric of the location, as opposed to being exclusive use for one building or a row of houses. So it’s more than just part of the estate and often is external to the development. Whilst you as the developer most likely will have to pay for it, its usage or benefit will extend to the general public.

The approach to add amenity profit starts with three questions;

- What location assets can we enhance with additional amenity? We could extend our forest walks to include a mountain bike track.

- What location liabilities can we offset with amenities? We could negotiate with the education department to fast-track a new school. We could work with neighboring developers to complete the roading network to the freeway. And we could include some catalyst retail for a trendy restaurant operator. And by catalyst I mean help pay their rent, at least until things start pumping!

- What new location assets will be created? Let’s add a lake. A golf course. The grandest of playgrounds. You know a neighboring developer will be creating their own trendy dining and entertainment cluster. If you want examples from the residential space, of themed amenity verging on the absurd (or maybe genius) then read about airstrips and waterskiing here or Zoo’s, Velodromes and Giving Trees here.

Some amenities to improve the location brand balance sheet will be under your full control. Whip out the credit card and start building tomorrow. But other amenities, especially the chunky transport infrastructure, will be subject to the decisions of government entities, the vagrancies of the local community and other developers.

Here’s our enhanced balance sheet updated.

Timing of Amenity. Plans change. The market tanks. Governments are kicked out. The council runs out of money. A new Mayor with an opposite agenda. The timing of new amenity and infrastructure that is provided by others is a decent risk with many master-planned projects. New amenity being delayed, completely redesigned or not eventuating at all can lay waste to your best (and horribly expensive) plans.

So the value to your location brand of new amenity and infrastructure should be discounted by both risk and time. The longer a buyer needs to wait, the less value to them. For example, a new primary/elementary school zone due to open in three years’ time does not hold much value for a family whose kids are ready to go to school next year. The proposed railway station that does not have government funds might only have a 50% probability of happening. The retail developer putting a shopping complex up next door may experience a market slowdown, delaying his plans – and shops for your buyers.

Don’t Forget the Profit. How do you know what and how much amenity to add, and when to stop? Some will be forced by regulation but there are so many assets you could deliver to improve your location.

Go and ask your sales team what amenity you should provide in to improve your locations brand. You might hear them recommending water fountains, bronze statues, a theme park, tree-lined avenues, fully mature palm trees and of course a lake with accompanying stone bridge and restored steamboat.

“Great what else” you enquire.

“Well can we pay to add another lane to the road fronting our project? That will help with the early morning congestion.”

“And an in-ground amphitheater, with olive grove and passionfruit plantation….”

Now, I’m sure this would more than likely add value, in a greenfield residential master-planned project or even a suburban office project but there is one minor problem.

Cash.

How much is it all going to cost? And am I going to get back more than I put in? That’s why I term it amenity profit.

The decision to add an amenity to strengthen your locations balance sheet is a simple algorithm:

If A > C then Y

A: Additional sales income generated because of amenity

C: Additional cost of amenity

Y: Yes, do it!

To paraphrase: in total, will people pay more for your real estate product because of additional amenity than the cost of providing that amenity. Easy.

Well, maybe not so easy. Calculating the cost is not difficult but trying to scientifically extract the incremental value add from a piece of amenity – isolated from all the other variables that affect real estate pricing, aka the market – well, good luck with that.

“So Ms sales consultant can I get 15,000 per house lot extra because there will be a lake down the road?”

“Mr leasing agent, will I get an extra $100 per square meter in rental because we have included ‘Japanese contemplation gardens’ around the base of each building?”

There is a lot of subjectivity involved. And a lot of developers’ artistic opinion. Any assessment of discretionary amenity (the infrastructure you choose to add, not obliged to because of planning regulations) must relate to the target market. Simplistically: the more affluent your target and the weaker the existing location brand balance sheet the more amenity assets you need to add. In low-cost affordable housing schemes, often irrespective of how little location brand equity you have, you just cannot afford to add many amenities. Sometimes when one comes to deliver all the amenity in the developer’s vision, it’s not a matter of delivering the dream, but that the developer is dreaming!

Mostly it comes down to what competition locations provide at similar price points plus your pioneering spirit and the corresponding depth of marketing budget. For example, 90% of the 50 top-selling master-planned communities in the United States in 2019 included a significant water amenity. Something serious to consider then, and probably enough data to approximate the lot premium achieved by providing this amenity to see if your target market pricing can justify it. But what about the amenity profit of ‘The Incline’ a 200-step outdoor staircase at the Meadows in Denver? or a BMX track?

A special note on cost. The design and construction cost of an amenity is only one component. If the amenity is on your project site, you have to account for the loss of Net Developable Area that is consumed. The profit generated by 50 more houses might be higher than the total premium achieved by taking out a hectare to build a lazy river!

And the time it takes to negotiate and gain consent from neighbors and the authorities, may also be a cost your project cannot bear.

Location Promotion

Then go forth and promote your location.

Promote all the existing assets focusing on the significant most valuable ones – the biggest drawcards to your location. Also, use those that are most interesting or unique which could lead to a great story in a marketing campaign and sales communications. For example, the site used to be an air-force fighter jet training base during WWII, or the famous poet used to live on a farm here. Once again, the angle has to have some buyer appeal.

Have the answers ready for the inevitable objections to your location. Do this for every existing liability and issue that has the potential to negatively influence a buyer’s decision.

- How can you turn a liability into a positive? A ‘cold and damp gully’, becomes a ‘wonderful shelter from the prevailing winds’. Or, a ‘lowly rated school zone’ becomes a ‘The high school has improved students grades for 6 years running now’.

- Maybe it’s best to ignore and don’t bring it up, except in the normal process of sales disclosure. For example, if the location was previously an old trash tip or had high concentrations of asbestos in the ground (now remediated of course).

- Can you deescalate its importance? “Look whilst there is no train station close by, the bus network is fantastic”. “Everyone who already lives around here loves the dining experience over there and Ubers back, no hassle, for less than $20.”

Promoting future amenity and infrastructure that is still a glint in an urban planner’s eye come requires stronger consideration. In the ideal world it all happens, on cue, and your sales team can set firm expectations in the minds of buyers – the dream you sell will become reality. However, when the provision of new amenity assets is in the hands of others, or the market changes dramatically so your pricing can no longer generate amenity profit (happens all the time, especially on master-planned projects that are not backed by deep pockets) the promised asset may be delayed or even terminated. So promotion of an amenity should not infer a promise unless you are certain.

As to the detail of how to promote, that’s too broad for this article and I won’t steal any real estate development marketers thunder just yet except to say the worse your brand balance sheet the more you are probably going to have to spend to generate interest. And in 2020 if you are a residential project, that could still mean old-school mass media like Television, radio, printed newspapers and billboards. As well as PR around open days, mayoral cutting the tape or someone semi-famous digging into the ground with a gold-painted shovel.

When to Promote

One strategy where you are creating a new project in the proverbial no-mans-land is to start promoting the location brand before you have product to sell. That could give you a head start in the market. Your promotion could frame it as the up and coming new location, and ‘watch this space’. Or you may wait to start promoting until some of your amenity profit is created – like a golf course or catalyst retail. Then potential buyers can experience tangible improvement in the locations balance sheet.

Where cashflow and budgets limit substantial investment prior to receiving income then you may be forced to launch location brand promotion concurrently with the real estate products you are selling.

Revisit the Location Brand Balance Sheet.

Your location brand balance sheet changes over time. You are adding assets. New liabilities arise. Others complete infrastructure projects. So updating the brand balance sheet, say annually, can generate good information to drive your marketing strategy and promotional activities for the following year.

Eventually, and likely well before you sell out you may no longer have to promote your location. Because you are now a known location and all the asset improvements have been delivered. Excessively promoting something everybody already knows is going to have diminishing returns. At that point in time, your master-planned project is just an existing part of its greater locations fabric. But don’t stop promoting your project!

A Note on Company Branding

Is the company brand so strong that location branding is somewhat superseded? This is when people buy on the strength of your company. Unlike most products though, real estate is firmly tied to the ground it sits on. So there are few circumstances where company branding will trump poor location equity. But once your location balance sheet is improved, if you are a well known and trusted quality deliverer of the product you promise, company branding can be a powerful stimulant to attract buyers and separate you from the competition.

And a Note on Estate Branding

In the largest greenfield master-planned projects – think new suburbs or an entire new town – location branding and estate branding are effectively one and the same. Therefore, a significant component of estate branding is the location branding we have already described. For smaller master-planned projects, now that you have burned the location into the hearts and minds of your buyer pool, you still need to convince them why your project is the place to buy or tenant.

In the next edition, we will discuss further differences in sales and marketing strategies for a master-planned project.

Cheers

Andrew Crosby

The DC: Master-planned Projects – All published editions.

#1 Roads

#2 Net Developable Area

#3 Feasibilities

#4 Stages

#5 Team Collaboration

#6 Architectural Design

#7 Scale Thinking

#8 Selling the Dream Location

P.S.

Now in this blurred world of social media versus professional media, my opinion versus my employer(s), salary versus side-hustle, middle of the business day versus 11pm on a Sunday evening, it can all get a bit confusing. So, here is my value proposition, and both complement and benefit each other.

- If you have a development site that you would like to sell some or all of, to develop yourselves, or to build houses then Universal Homes www.universal.co.nz might be able to help. We focus on delivering value-for-money homes in the ‘relatively affordable’ range, like the 1300 home westhills.co.nz or the 600 plus homes we have built at Hobsonville Point, or the thousands of others around Auckland over the last 60 years. Message me on LinkedIn at any time

linkedin.com/in/ajcrosby . - If you want to learn more about real estate / property development and a continuous improvement approach, with books and courses in development management to maximize profit and decrease risk then visit www.developmentprofit.com